Dental Health Literacy Pamphlet for Employees | Basic Dental Coverage Terms (B2B)

By Shelby Tatomir on July 30, 2019 in Insurance

Ensure your employees understand their insurance policies and know how to make the most of them with this handy infographic. Print it out and post around the office, or send out in an email for safekeeping.

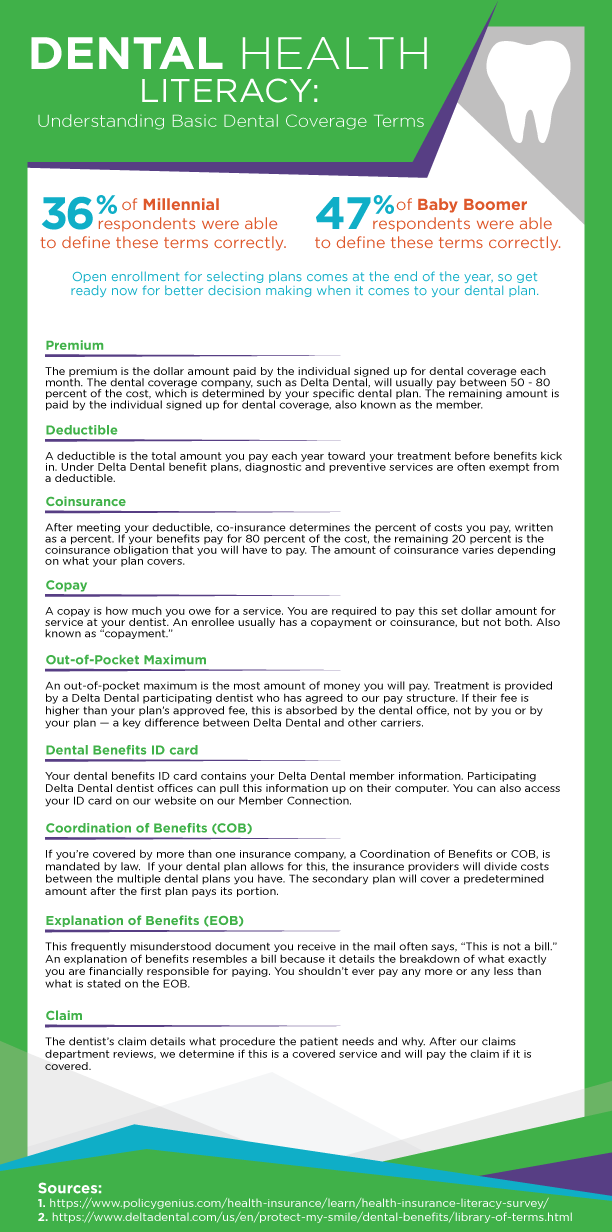

36 percent of Millennial respondents were able to define these terms correctly, whereas 47 percent of Baby Boomer respondents answered correctly. This handy guide can help your employees during your open enrollment period. It is never too early to get your employees up to speed on the insurance terminology!

Premium

People generally know what a “premium” is because they have to pay it. But, when other terms come into play, people aren’t so sure they know what their policy entails. The premium is the dollar amount paid by the individual signed up for dental coverage each month. The dental coverage company, such as Delta Dental, will usually pay between 50 - 80 percent of the cost, which is determined by your specific dental plan. The remaining amount is paid by the individual signed up for dental coverage, also known as the member.

Deductible

A deductible is the total amount you pay each year toward your treatment before benefits kick in. Under Delta Dental benefit plans, diagnostic and preventive services are often exempt from a deductible.

When surveyed, 74 percent of people were confident they knew what a deductible was. But, only 50 percent correctly defined it.

Coinsurance

After meeting your deductible, co-insurance determines the percent of costs you pay, written as a percent. If your benefits pay for 80 percent of the cost, the remaining 20 percent is the coinsurance obligation that you will have to pay. The amount of coinsurance varies depending on what your plan covers.

When surveyed, 47 percent of people were confident they knew what coinsurance is. But, only 22 percent correctly defined it.

Copay

A copay is how much you owe for a service. After meeting your deductible, the insurance company will pay their coinsurance, or the percent of costs that they’ll cover. Whereas coinsurance is written in a percent, copay is usually a dollar amount.

When surveyed, 83 percent of people were confident they knew what a co-pay was. But, only 52 percent correctly defined it.

Out-of-Pocket Maximum

An out-of-pocket maximum is the most amount of money you will pay. Treatment is provided by a Delta Dental participating dentist who has agreed to our pay structure. If their fee is higher than your plan’s approved fee, this is absorbed by the dental office, not by you or by your plan — a key difference between Delta Dental and other carriers.

When surveyed, 67 percent of people were confident they knew what an out-of-pocket maximum was. But, only 42 percent correctly defined it.

Dental Benefits ID Card

Your dental benefits ID card contains your Delta Dental member information. Participating Delta Dental dentist offices can pull this information up on their computer. You can also access your ID card on our website on our Member Connection.

Coordination of Benefits (COB)

If you’re covered by more than one insurance company, a Coordination of Benefits or COB, is mandated by law. If your dental plan allows for this, the insurance providers will divide costs between the multiple dental plans you have. The secondary plan will cover a predetermined amount after the first plan pays their portion.

Explanation of Benefits (EOB)

This frequently misunderstood document you receive in the mail often says, “This is not a bill.” An explanation of benefits resembles a bill because it details the breakdown of what exactly you are financially responsible for paying. You shouldn’t ever pay any more or any less than what is stated on the EOB. Check out our blog for more details on EOBs.

Claim

The dentist’s claim details what procedure the patient needs and why. After our claims department reviews, we determine if this is a covered service and will pay the claim if it is covered.

Learn more about your dental plan: